In a significant move towards a greener future, the European Union has expanded its Emissions Trading System (EU ETS) to include maritime transport emissions, effective from 2024. This extension aligns with the EU’s commitment to reducing greenhouse gas emissions and combating climate change.

Understanding the EU ETS Framework

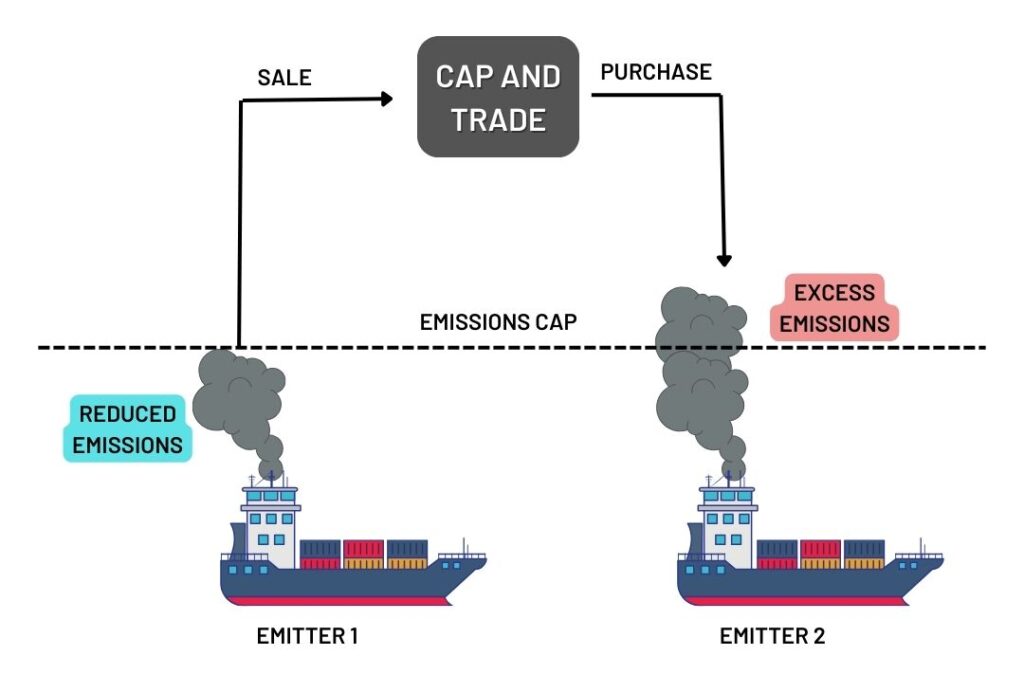

The EU ETS operates on a ‘cap-and-trade’ mechanism, setting a yearly cap on the total greenhouse gas emissions allowable for covered operators. This cap reduces annually, in line with the EU’s climate targets, with the overarching objective of achieving a 62% reduction in emissions from 2005 to 2030.

Operators are allocated emission allowances, each representing the right to emit one ton of carbon dioxide equivalent (CO2eq). If a company exceeds its allowances, it faces heavy fines. These allowances can be bought and sold through auctions and secondary markets, providing flexibility for companies to reduce emissions in a cost-effective manner.

Monitoring, Reporting, and Verification (MRV) in Maritime Transport

Shipping companies under the EU ETS must adhere to the MRV Maritime Regulation, covering carbon dioxide (CO2), methane (CH4) from 2024, and nitrous oxide (N2O) from 2024. They are required to submit annual emissions reports verified by an accredited verifier, promoting transparency in emissions data through platforms like THETIS-MRV.

Carbon Pricing and Extraterritorial Application

The EU’s carbon pricing strategy under the EU ETS is a crucial step in the fight against climate change. It now extends its reach to vessels, focusing on emissions rather than cargo. The extraterritorial application means that voyages between EU and non-EU ports will be subject to the EU ETS, addressing concerns about carbon leakage.

To manage the potential impact on shipping costs, the phased implementation of carbon pricing for shipping companies begins in 2024, gradually increasing to cover 100% of verified emissions by 2026. Furthermore, the inclusion of nitrous oxide and methane emissions from January 1, 2026, signals a commitment to broader greenhouse gas reduction.

EU Allowances (EUAs): Cornerstone of the Cap-and-Trade System

EU Allowances (EUAs) are the currency of the EU ETS, allowing companies to emit a specified amount of CO2eq. Auctions on platforms like the European Energy Exchange (EEX) and secondary market transactions facilitate the procurement of EUAs. Compliance with monitoring, reporting, and verification requirements is essential, with heavy penalties for non-compliance.

Emissions Auctions and Market Participation

Emissions auctions are a key component of the EU ETS, allocating allowances through platforms like EEX. Eligible participants include compliance buyers, investment firms, and other authorized intermediaries. Auctions take place regularly, offering opportunities for market participation and the procurement of EUAs.

Varuna Marine Services B.V.: Navigating the EU ETS

Given the volatility and complexity of the EU ETS, companies can turn to Varuna Marine Services B.V. for assistance. We offer services such as setting up EU Registry Accounts, providing market information, and offering perspectives on EUA prices. For inquiries, contact the our team at [email protected] or call +31 687382356.

In conclusion, the extension of the EU ETS to maritime transport represents a landmark move towards a sustainable and low-carbon future. With careful navigation, adherence to regulations, and strategic planning, the shipping industry can play a pivotal role in achieving the EU’s ambitious climate goals.